NBP Itmenan Term Deposit / Current Account (FAQs)

Q. Who can apply for NBP Itmenan Current Account?

- Senior citizens having age 60 years and above as per DOB mentioned in CNIC

Q. What are some of the main features of NBP Itmenan TD Account?

- Attractive Rates for 1, 3, 5 and 10 years.

- Profit is to be credited monthly in linked checking account.

- Min. investment of Rs. 100,000 with a cap of Rs. 50 Million.

- Upfront pre-approved RF facility @ 10% of TD amount and max Rs. 1 Million, whichever is lower, which could be extended up to 70% (max age of 75 years).

Q. What are some of the main features of NBP Itmenan Current Account?

- Fee waiver on annual fee of Pay Pak card issued against linked account.

- Life Insurance cover up to Rs 100,000 (max age of 65 years).

- Debit card discounts (GoLootlo) on health and allied products e.g. lab tests, dental clinics, pharmacies etc.

- 1st cheque book free (25 leaves)

- Free mobile app and online transactions for fund transfer, bill payments, mobile top up etc

Q. What are the available investment limits?

- The minimum amount required for investment in NBP Itmenan Term Deposit Account is set as Rs. 100,000/- and maximum amount of investment allowed is Rs.50 million.

Q. Can the account be closed before maturity of investment?

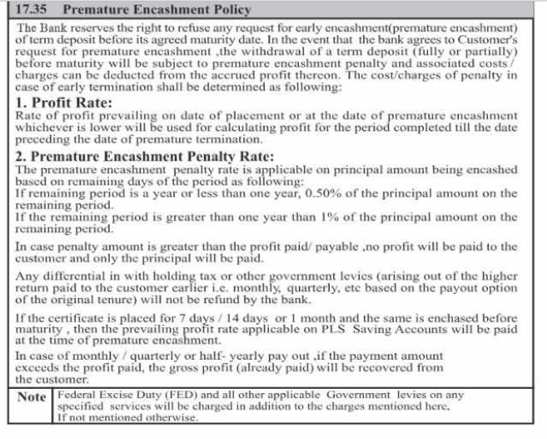

- Yes, however following rules govern pre-mature closure of account:

Q. Is zakat and WHT applicable on Itmenan Term Deposit?

- Zakat, where applicable, will be deducted for each year on principal amount. Withholding tax to be deducted from the profit of the term deposit as per rules.

Q. What is the profit calculation mechanism?

- The maturity of the product ranges from 1 year to 10 years. Profit will be paid monthly on daily accrual basis. In case the profit rates are revised, the revised rates will be applicable only on fresh issuance. Profit rates for already issued TDs will remain unchanged till the holding period of the investment.

|